Palmpay, an automated lending service, has a goal to ensure that those who need loan, gets access to it. They aim to serve Nigerians and Africans at large who are not financially stable or who one financial need. Palmpay is a financial platform that provides its users with loans as a means of financial assistance. In addition to loans, you can pay your bills and make transfers from the comfort of your home. The loans require fewer documents to apply for and are instantaneous.

With the emergence of recent technology, especially in the financial sector, getting access to loan is now very easy, but still, one of the easiest loans to obtain without collateral or paperwork is the Palmpay loan app. The emergence of fintech companies has significantly transformed the banking industry. The cherry on top is that borrowers can easily apply for loans without any hassles from the comfort of their homes.

Palmpay can grant you a loan in the shortest possible time if you require one. It’s possible that you will receive money in your account within five minutes. The good part is that there’s no need to fill out a ton of paperwork or provide anything as collateral. With Palmpay, getting loan is as easy as “A B C”. Additionally, you can borrow up to NGN 10,000 if you’re new to Palmpay.

How Is Palmpay Different From Other Loan Apps

Although we have so many financial platforms that gives access to loans from the comfort of your home, still, Palmpay remains unarguably one of the best loan apps. Some of its distinguishing factors are;

- Flexibility: Flexibility is the primary feature that sets the Palmpay loan apart. With Palmpay, you can decide how much loan you want and also you get to choose a very flexible payment plan. Put differently, you decide how long your loan will last. Interesting right?

- Fast: honestly, the speed at which Palmpay disburses its loan still remains unrivaled by other loan apps. The application process as well, is very fast and seamless. This gives Palmpay an edge over other loan apps.

- Very low interest rate: with an interest rate of 15% to 30%, Palmpay offers one of the lowest interest rates as compared to other loan apps. The interest rate is so small that it almost feels like you aren’t even paying an interest.

- No Collateral needed: Palmpay doesn’t require you to bring a collateral before you can have access to loan.

Conditions and Requirements to Apply for Loans on PalmPay

Before your loan application on Palmpay can be approved, you must have met the following conditions;

- You must be a citizen of Nigeria or a Nigerian resident

- You must be at least 18 years old

- Another requirement is that you have a valid BVN

- It is impossible to apply for loan on Palmpay without having a valid PalmPay account

- Income and employment status, this shows that you will be able to pay back the loan.

- Debt-to-income ratio

- History of using the PalmPay app

- Having a good credit history is another important condition to be met. This means you must not owe other platforms or be blacklisted by any lending platform.

- The loan is transferred right away to the recipient’s bank account upon approval. Thus, another prerequisite is to maintain an open account with any of Nigeria’s commercial banks.

- You will also be required to have a valid means of identification

- Lastly, you need a mobile phone and good internet connectivity.

How To Borrow Loan From Palmpay Without BVN In Nigeria

if you have been wondering how you can borrow loan from Palmpay, then we have got you covered. You get a loan from Palmpay, follow the simple steps below;

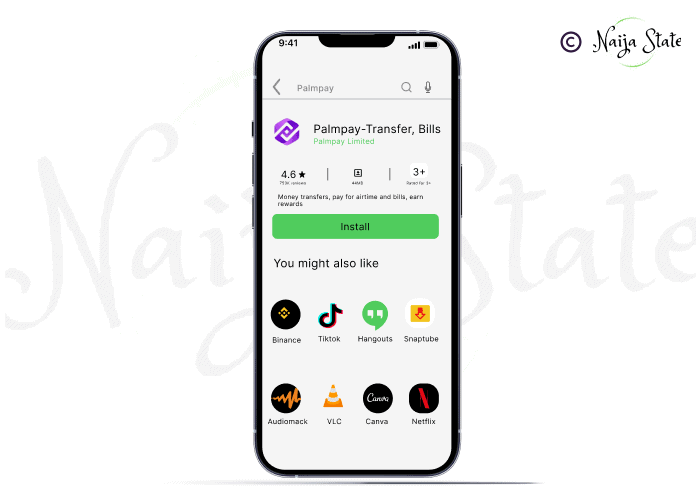

- Download and install the PalmPay app on your mobile device: the Palmpay app can be downloaded on both iOS and android devices using these links; for android and for iOS

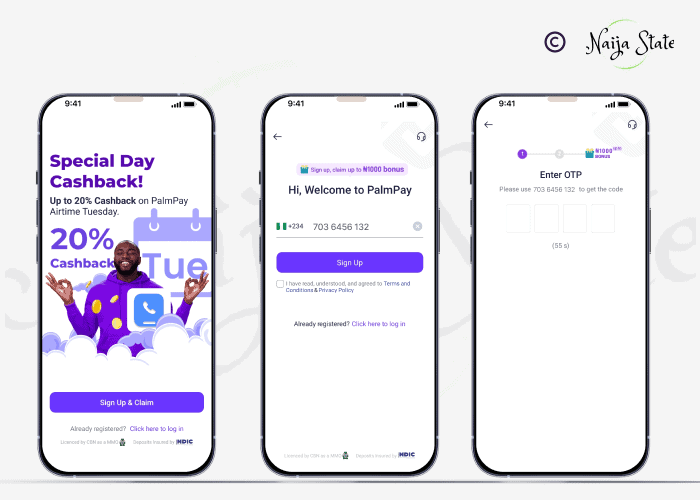

- Next, create an account; To create an account, fill out the registration form with your personal information. Or just follow the steps below;

- Open the application

- Press the “sign up” button.

- Put in your phone number or email address.

- Make a secure password. The password is usually 4 numbers.

- Send it in and watch for confirmation.

- You will receive a verification SMS on your phone number or email address. Depending on the one you requested for.

- After registering, go ahead and add your BVN and other information.

- Permit Palmpay to access your device as well.

- You will be able to access your personal dashboard once your registration has been approved.

- To find out how much you can borrow, go to the ‘Loans’ section of your dashboard and fill out an application. The steps to do that are;

- Open your application and navigate to the dashboard.

- Navigate to the Service or Finance tab.

- Select “Credit & Loan.”

- Put in the required information.

- Select the desired amount, being careful not to go over your loan limit.

- Send in your application. The management group examines and gives it their approval.

- Upon approval of your loan, you can go ahead to withdraw it.

What Is The Loan Limit For Palmpay?

Palmpay allows you borrow N10000 as a first-time user and as much as N200000 as an existing user with a clean credit history.

What’s Palmpay’s Payment Plan?

Interest rates on loans from PalmPay range from 15% to 30%. Both the loan amount and your credit score have an impact on this rate.

Repayment of the loan can take anywhere from one month to a year. New borrowers might initially have shorter repayment terms and higher interest rates, but as long as you make consistent on-time repayments, your terms will get better.

Repaying Your Loan

To repay your Palmpay loan, follow these steps;

- Open the PalmPay app and sign in with your credentials.

- Choose the loan you wish to repay by clicking on the “loan repayment” icon.

- After deciding on your repayment plan, submit your application.

- After approval, your account will be debited right away.

What Happens When You Default On Your Loan Repayment

It is not uncommon to see people defaulting on their loan repayment, but trust me, this attracts severe penalties. Some of which are;

- Your interest rate increases from 15% to 20%, i.e., a 5% rate addition.

- Second, if you continue to disregard the platform after the first penalty, the Credit Bureau will put you on a blacklist, which will prevent you from getting loans in Nigeria until your debts are paid off. (so, to avoid these penalties, ensure you pay back after you borrow loan from Palmpay)

Conclusion

Palmpay offers one of the best services when it comes to loan collection. This article already covers all you need to know about the Palmpay and how to borrow loan from Palmpay.